Financial Solutions

Context

Oil palm in Colombia is a crop of high socio-economic importance, particularly for thousands of small farmers that provide about 50% of total production, as it is found in regions with a low presence of the State and mostly affected by the armed conflict. In 2019, total production in Colombia reached 1.5 million tons of crude palm oil produced on 530,000 hectares. The sector represented 11% of agricultural GDP, generating jobs for more than 170,000 workers and benefits for around 400,000 people. Colombia is the fourth largest producer of palm oil in the world, with a share of 2% of world production and 1.7% of the total palm oil marketed worldwide, and the leading production country in Latin America.

The overall share of certified palm oil in Colombia increased from around 5% in 2014, to around 27% in 2019. While RSPO and Rainforest Alliance (RAS) certification have already been used for several years, Colombian companies obtained ISCC certification for the first time in 2017. Despite the late introduction, the share of ISCC certified production has grown rapidly to 8% of domestic CPO production in 2018, while RSPO and RAS accounted for 15% and 3% respectively. Only 5.5% of the 4,500 small farmers in Colombia have RSPO or RAS certification. It is of the utmost importance to continue strengthening the implementation of sustainable practices and, in turn, to develop research that allows the validation and contrast of progress. In recent years, corporate purchasing policies and public legislation in large consuming countries have become increasingly stringent to curb deforestation in the palm oil supply chain. International pressure on producer countries has increased to address the challenge.

In order to improve the sustainability performance of the palm oil sector, investments at farm level are required, but access to finance is very limited for the 6000 smallholders. Most producers are geographically located in rural areas that lack financial institutions or are underserved by banks. The size of individual loans is small and there is a shortage of hard loan collateral (e.g. land title and/or house ownership). The processing mills oftentimes fall short in their capacity to diversify lending to smallholder farmers or do not have the appetite to do so due to high operational costs to provide financial services to farmers. Moreover, the absence of accurate financial information and inconsistent data leads to subjective, inconsistent and uninformed credit decisions. Therefore, the provision of working capital from formal financial institutions for on-farm improvements according to sustainability standards, is almost non-existent and, if available, comes at high costs. Rural financial products and services in which costs and risks are reduced or shared have become a crucial condition to provide the working capital for the adoption of sustainability practices in line with the Voluntary Sustainability Standards and Zero-Deforestation requirements.

Justification

In April 2021, the German government’s technical cooperation agency for development, GIZ, through the INCAS Global + program, approved the project SOAPS: Sustainable Origin Accelerator for Palm Oil Supply Chains.

The key objective of the Sustainable Origin Accelerator for Palm oil (SOAPS) programme is to accelerate the sustainable transformation of global palm oil supply chains and to achieve fully traceable, sustainable and zero-deforestation supply chains from the field to the shelf. As one of the specific objectives the SOAPS programme will provide small and mid-size producers access to inclusive financial products for producers that enable them to increase productivity and compliance.

SOAPS aims to increase the access to finance for producers to ensure provision of working capital for on-farm investments. Based on the collected farm data, the programme will elaborate tailored investment plans for the participating farmers. These investment plans will be financed through rural credit schemes managed by the participating processing mills and/or rural finance institutions. The SOAPS programme will leverage through its partners working capital for the palm oil producers. Investment opportunities with rural banks, investment funds and financial institutions will be identified. In order to increase the investment appetite, a Risk-Sharing Facility will be designed and developed for the clusters of palm oil producers, through which part of the underlying farmer risk is absorbed. This deliverable includes the support for potential bank or investment funds with the application, in which details such as the structure, underlying risks and mitigants, the reporting mechanism, the envisaged impact, will be worked out. The Risk-Sharing Facility will be operated and implemented under the Public Private Partnership between the global supply chain stakeholders.

Banks usually perceive investments in (smallholder) agriculture as high-risk, high cost, and with low returns. This prevents producers in the palm oil supply chains to finance the improvements required by Voluntary Sustainability Standards. Palm oil processing companies in supply chains play a major role in de-risking investments or providing loans for sustainable palm oil production at the farm level. Blended finance models and alternative financial products represent additional opportunities for farmers to access financing to improve their business. However, blended finance solutions to increase bank lending to farmers are difficult to structure and implement. Incentivizing local banks to increase lending activity directly to smallholders has been a key theme in agricultural development for some time, with many pilot projects, but few scaled solutions.

Objective

SOAPS aims to increase the access to finance for producers to ensure provision of working capital for on-farm investments. Based on the collected farm data, the program will elaborate tailored investment plans for the participating farmers. These investment plans will be financed through rural credit schemes managed by the participating processing mills and/or rural finance institutions. The SOAPS program will leverage through its partners working capital for the palm oil producers. Investment opportunities with rural banks, investment funds and financial institutions will be identified. In order to increase the investment appetite, a Risk-Sharing Facility will be designed and developed with the contracted party for the clusters of palm oil producers, through which part of the underlying farmer risk is absorbed. This deliverable includes the support for potential bank or investment funds with the application, in which details such as the structure, underlying risks and mitigants, the reporting mechanism, the envisaged impact, will be worked out. The Risk-Sharing Facility will be operated and implemented under the Public Private Partnership between the global supply chain stakeholders.

Results

The general benefits from the implementation of the proposal are:

Outputs / Products

- Based on Solidaridad’s analysis of characteristics of Colombian palm oil value chain and identification of the various financing challenges, map out a number of theoretical blended finance structures through which Banks and Value Chain Players can finance the requisite investments at the Farm level with the engagement of a yet-to-be-identified Fund.

- Facilitated by (1), identifying the risk appetite of pertinent Value Chain Players and their appetite for a blended finance solution, including but not limited to credit risk participation, the operational aspects of (in kind) lending and repayment, technical assistance, minimum price and volume commitments, etc.

- Mapping of which Funds, nationally and internationally, may be well positioned to best support the identified structures. This overview will complement Solidaridad’s own overview.

- Introducing the financing opportunity plus de-risking options to a select number of Banks to gauge appetite to participate in funding and risk participation. Steps 1, 2 and 3 should be largely completed at this stage, so as to present a detailed and compelling proposition to the Banks (In case no Banks can be found willing and able to provide funding to the Farmers, the option of directly funding and/or de-risking Value Chain Players will be explored)

- Together with Solidaridad, decide which Bank to partner with for this project (the “Partner Bank”) .

- Facilitating the cooperation between the Partner Bank and a Fund on the risk sharing arrangement.

- Support in the design of the blended finance solution to the Partner Bank, in case required by the partners.

- Complete the design of the blended finance solution to the Partner Bank, ensuring its readiness for application among the Value Chain Players.

Outcomes / Results

- To support the increase of production of sustainable palm oil in Colombia

- To improve the risk profile of (smallholder) palm oil farmers in Colombia

- To increase access to finance for (smallholder) palm oil farmers in Colombia

- To assist Value Chain Players to build innovative finance models with Banks to enable investments in sustainability at farm level

- To unlock commercial funding by Banks for the sustainable production of palm oil

Deliverables

- Feasibility analysis on risk and debt appetite by the relevant Value Chain Players and Banks, including the work-out of one or more blended finance structures that seem best aligned with the interest, appetite and capacity of the interviewed parties (document between 15- 20 pages plus annexes) ready by month 3

- Overview possible Funds for risk sharing purposes and advice on which one(s) may provide the best fit as per the opportunities and limitations identified in step (1) (document between 10- 15 pages plus annexes) ready by month 4

- Provision of support to the Partner Bank in applying to the Fund for a risk participation (2 progress reports of 3-5 pages) ready by month 6

- If necessary full support to the Partner Bank in issuing a tender for Funds to respond to (tender document between 10-15 pages plus annexes) ready by month 8

- Supporting the Partner Bank with the implementation of the blended finance solution with limited days of advice (to be used at the Partner Bank’s behest) ready by month 8

- Elaboration of report about the design and recommendations for the implementation of the blended finance solution to the Partner Bank (between 10-15 pages plus annexes)

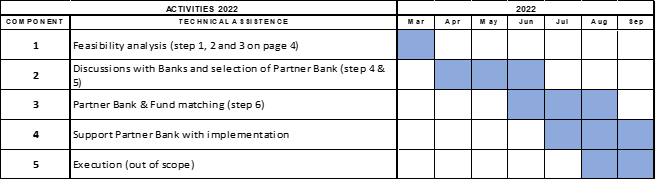

Schedule

Participants

The direct participants in the project will be:

- FEDEPALMA: At the producer organization level, leader of the Sustainable Oil Program of Colombia, with its management, technical and administrative team. With his capacity for regional leadership and communication with other actors.

- SOLIDARIDAD NETWORK: Organization to support coordinated work between actors, with experience and access to digital tools, management models and training of farmers.

- PALM NUCLEUS PRODUCERS: Direct actors and beneficiaries of the actions of change in the technologies of production and sustainable management in the cultivation of oil palm.

- CREDIT INSTITUTIONS: Entities that offer credit products which can be entities supervised by the Superfinancial or Supersolidaria. National or international non-supervised entities can also be included.

- DONORS OR MULTILATERAL ENTITIES: Organizations with social objectives or objectives related to financial inclusion or the improvement of the living conditions of vulnerable communities, which can provide different types of risk coverage

Administrative requirements of the contract

According to the grant agreement with GIZ the sub-recipient must:

- Implement time sheets to record the hours of dedication of staff to the project and allocation of costs monthly.

- According to annex 4a of the general agreement, it is established that for purchases or contracted services of EUR 1,000 to EUR 20,000, at least 3 comparable quotes must be obtained to justify the award of each corresponding transaction.

- In the case of contracting services, the details of the selection process must be included, documenting the competencies of the different candidates and the final choice.

- The sub-recipient must provide a financial report and provide documentary evidence with the expenses incurred through the resources assigned in the proposal, cut off on 06/30/2022 and 09/30/2022.

- The sub-recipient must adhere to the advertising and communications agreements of the agreement to ensure that GIZ is identified as the funder of the activities.

Budget

A total budget of sixty-one thousand and two hundred euros (61.200 EUR) is estimated for the development of the activities detailed in this proposal, for six (6) months from March 18, 2022, until September 30, 2021. The total budget includes VAT and all applicable taxes. Deadline for submitting the proposal is Wednesday, March 16, 2022